Your business is starting to hit its stride, with a good team and strong KPIs. After careful consideration, you feel it’s time to go get funding from one of those prestigious Venture Capital funds. Have you created your pyramid of priorities?

I’m assuming here that you’ve done your homework, you’re well prepared, have your documents lined up and are pitch-ready (if you’re not, check us out, that’s what we do).

What do most of you do then? Go and talk to any investors. In fact, anybody who may/might/maybe/one day look like an investor.

It’s natural, and simple logic: the more encounters, the more chances, right?

Statistics, right?

Wrong.

Yes, I too believe in serendipity, chance encounters, sheer luck etc…but one thing is sure: connect with investors in the wrong order and you’re almost guaranteed to kill your funding process.

So don’t.

Why?

Because all investors are not born equal.

It’s so obvious when you think about it, but weirdly enough, most CEOs don’t use it to their advantage – and you should. Learn their psychology and you can play them off to gain big.

You see, in the dog-eat-dog world of Investment there is quite a lot of ego, competition and jealousy at play (I know, incredible, right?).

Newbies, i.e. new funds, typically start with smaller funds, have smaller market reach and reputation. So they hunt deals hard.

The older and more established industry peers see most deals and aren’t exactly sharing them with the newbies, especially hot startups. So you have this virtual pyramid of priorities where top layer VCs see and choose from the best deals without sharing with lower-echelon investors, while newbies are very (very) keen to co-invest with top name funds because it helps them massively to build their brand, credibility and their chances of raising the next fund.

And that’s how you play them off to your advantage.

Nobody will chastise you if a top tier fund turns you down. They see the very best deals, so they’re very, very picky, sometimes overly; no one will think less of you for it.

But getting turned down from a lower-class VC fund? You’ll never get a meeting (let alone cash) from a higher layer top fund. The logic goes “if you’re not good enough for a lesser fund I’m not wasting my time on you.”

Pure ego at play.

That wouldn’t matter if they kept quiet; nobody would know you were turned down, no harm done, move on.

Sadly, those at the bottom are also those who (typically, there are exceptions) speak out the most and claim the most (“oh yeah, we saw XYZ and we passed”), to show off and prove they get deal flow. Analysts are friends, usually worked together at a firm (they all change firms every two years or so, taking with them the pile of secret pitch decks) and they’re not so silent after a few pints.

So in short, everybody knows.

Now the good news: conversely, when you receive interest (term sheet) from a top fund every other investor below will want to get involved. You’ll create a daisy chain of interest.

I’m sure you heard of “last minute deals”?

That’s what it means.

“Ohh, Index gave a Term Sheet? Please call me”

Happens every week. Sometimes it’s not even that important what you do or how good your business is. They’re investing to grab that chance to co-invest with that top-layer VC Fund XYZ. Big win for their website and for their next fund’s pitch deck (“we co-invest with top-quartile funds like Big-Name-FundXYZ”). Everybody wants to co-invest with those further up the chain, no one wants to share deals with those who are further down it.

Again, pure ego at play.

So there you have it: Ego runs a big (but silent) part of the investment process.

I know, it’s sad, so childish but… that’s how it goes. The better question is: so how do I generate that daisy chain? Let me tell you your three steps to glory.

Step 1 • Stop All Chats

No more informal chats, “have a coffee” or “pick your brain about something“ chats with any investor. Why? Most likely, you’ll be invited to a chat by the bottom of the pyramid of priorities first, and you don’t want them to announce to the market that they met you and passed. You want to meet them last, not first. So thank them politely for their interest, explain you’re not ready to discuss yet but you’re preparing your funding process, let’s meet later.

Note: every chat or call or meeting, however casual they appear, is a pitch – if the investor doesn’t like the sound of you or what you’re doing, you are done. You won’t even get invited to a proper pitch meeting. “Oh, you’re doing something really great, but it’s a bit early for us, come see me again for the next round” will be your most common reply. So consider every encounter like it’s your last one.

Step 2 • Curate your target list aggressively

You are going to need around 60 investor meetings to complete your Seed round, or around 30 for a Series A, and it’ll take you from 3 months minimum to 6 months (average), possibly more. It’s a marathon, not a race. You need to have enough good investor options left at the end of the race to get yourself a deal whose terms are acceptable, and ideal investors competing for a position. So you’re going to need a list of highly (I mean, highly) qualified investor targets, to begin with.

Anything but highly qualified, you are simply:

a) wasting everybody’s time

b) ruining your reputation (for example, you might need them later, so don’t approach late state funds for seed and vice versa).

Start with 100 names.

Yes, I know, it’s tough to get 100 qualified names, but there are data sets and lists everywhere on the web. Then filter them out aggressively (Do they invest in your geography, sector and at your stage? Have they invested in competition? Are they nearing their fund’s end of life etc. Assessing funds is another critical skill you must learn fast to avoid wasting time.

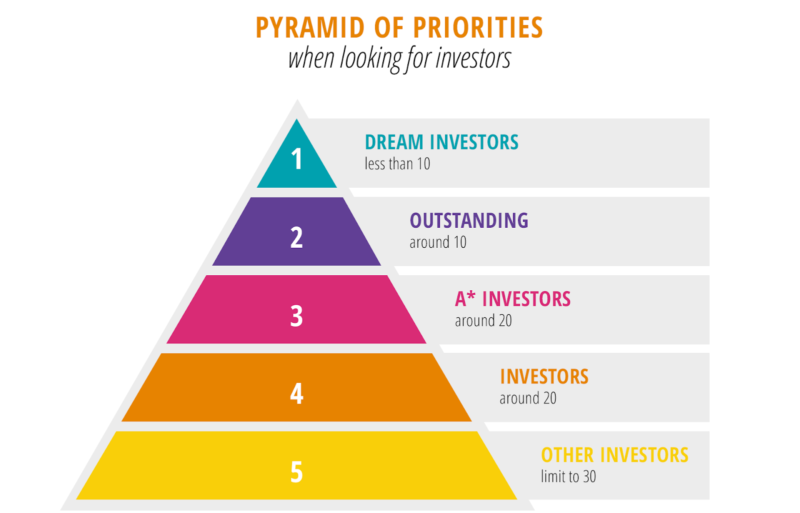

Then build what we call in our Fundraising Bootcamp your Pyramid of Priorities.

Pyramid of Priorities

Your dream investors, the global superstar funds, go to the top

You’ll most likely get a quick no from them but you’ll never regret not having tried, and you’re getting on their radar for a later round.

A* investors. Less hyped but outstanding funds

Again, not many and most likely you’ll be turned down quickly, same benefits as above. Investors are good to great investors but less prestigious. That’s your sweet spot. You can split them into multiple levels as we do in the example above, depending on how many you have. They should be experienced, strong in your sector and stage, and have added value beyond cash to bring to your table.

Other investors

Unknown or less familiar funds, and everybody else who should or might have an interest in your business. There are layers within that section but you don’t have time to differentiate.

Look at the image above: you should end up with around 10 dream funds, 10 outstanding, up to 20 A* funds, 20 interesting funds, and no more than 30 standard funds. Play with your PoP as much as you want, but follow step 3:

Step 3 • Work your way down the pyramid of priorities

Now it’s time to approach your prospective investor list in a quite obvious way: from the top, only.

Stop or postpone all other conversations, no matter how warm a lead you think they are. Address each investor in your Dream layer individually, no mass-mailing.

Give the person a 10 day to 2 weeks head start.

Explain why you are giving them such a preference over all other investors.

Keep it factual – you said this on stage, you wrote this, podcasted this, invested in this… etc – it shows that you pay attention.

Give them reasonable time to read, think about it, and engage. They are super busy and there are other fires burning elsewhere that may need their undivided attention.

Send two email reminders within the period.

If all three are left without any reply (which is very common), send them a final closing email and move on.

I usually finish the email with “This is my last email, you will not hear from me again”, and 80% of them reply. They can’t help it, it’s human.

One day after the two weeks have expired, move to the next layer.

Repeat as above.

Three Basic Rules for Fundraising Success

There are three simple rules you must keep in mind at all times.

Rule #1: Use the Pyramid of Priorities

Work your way down the pyramid, don’t skip layers. No exception.

As you get noticed by top layer investor/s other investors will hear about it and try to connect. Kindly but firmly ask them to wait their turn, “sorry I’m handling a sensitive matter right now, I’d love to speak/meet/talk, can we speak on [date]?” and update your CRM pipeline.

Rule #2: Get Introductions

I know that you know, but you tend to forget it (or ignore it, then regret it), so I’ll repeat it here: get introduced. A trusted third party to that investor is worth gold. What you’re after is one of the investor’s portfolio CEOs, ex-colleague, co-investor, LP… and LinkedIn is your best friend.

Don’t just use yours. Ask for favours and use your friends’ LinkedIn too to find a path to a shared contact. Use the one-click-forward email format (it’ll give you a success rate 10 times greater than standard intro request emails).

Failing that, use the approach cold-call email format.

Structured well (short, data-first and focused on a call/meeting, not investment already), a cold-call email still is one of the best tools you have if you can’t get any introduction (and VCs are increasingly responding to cold emails).

Our Bootcamp can teach you both formats if you have no clue what I’m talking about. As always, have your deck ready.

Rule #3: Don’t take it personally

Fundraising is a hell of a marathon, so stick to the process. Tick off the list, move on, next. No emotion, no exception, no deviation from your plan. Play the room.

As soon as you have your first commitment (usually a term sheet), go back to the investors sitting on the fence and to the no-replies. Send them a short update email and name-drop if it’s a Dream Layer investor. They’ll engage.

Remember: for most, it’s about co-investing with one of the top VCs, as much as it is about you.

This doesn’t apply for same-class investors in the pyramid of priorities, as they could collude and set the terms – not to your advantage, obviously. Even if they claim they would never do that, don’t take that risk.

Explain that you have £€$ xxx left in the round. As more soft commitments turn to term sheets, go and keep updating the stragglers: investors love joining at the last minute. Better still, join deals they weren’t invited to (some ego thing, being able to sell themselves in).

It is truly a cascade of interest.

Nailing your first commitment is the hardest, then as others join the round things turn to your advantage and you can finalise who you let into the deal and who you no longer favour.

So there you have it.

A few practical and logical tips to ensure you never regret something you didn’t do in the right order, and to ensure you get the best possible investors for your round.

We have tons more, let’s connect and discuss.

Good luck!