The press loves to tell us how investors are compelled to invest by the company’s vision or mission, the founder’s “charisma” or the personal experience that drove her to build the startup.

In my experience that’s not entirely true.

Yes, mission and passion are important, but sadly they’re additional, not primary, reasons to invest, and the reality is way more mundane: financial returns. Driving massive financial returns is the compelling reason.

That’s why investors love numbers. They devour them, crave, and love hard data. Yet, let’s face it, even though financials are critical (they can make or break your funding round) most founders dislike presenting numbers and typically hate Excel modelling. It’s tedious, time-consuming, and frustrating, it pushes them outside their comfort zone (product, features, vision etc) and worse, it can expose their obvious weakness with numbers. So what do they do? Copy/Paste the entire P&L spreadsheet into one page, close their eyes and hope investors skip as it’s so complicated and boring. Wrong. You fail.

Thankfully, there is a solution and it doesn’t require you to become a Master Jedi.

Introducing: Financial Storyline

The advice we give to companies joining our Fundraising Bootcamp is: don’t run away from numbers, and don’t obfuscate, complicate or make them difficult to grasp. Instead, focus on simplicity (yes, really) and clarity, leaving plenty of space for questions.

Investors (especially early-stage) have to make (very risky and costly) decisions with very little data. You typically have little traction to show, little cash flow or revenue certainty, widely-changing forecasts, no assets if things go wrong, etc. So even if their “gut” tells them that there’s something good in your business, they will need to back their hunch. That means putting aside their enthusiasm and gut feel and focusing on hard numbers.

How big can your business become? How much money will you need to burn before break-even, modest profits (if ever) and then true high growth? How long will this realistically take? Or in other words: in plain English, can you return their entire fund?

So they need numbers and clarity – and it’s your job to give it to them in a way that provides clear pointers and answers, not headaches and doubt.

Make the financial storyline tell your story

We always say it in all our cohorts: don’t shy away from numbers – even if they’re little more than a forecast.

Remember: Simplicity, clarity, and plenty of space for questions.

Simplicity.

DON’Ts in your Financials

- 25 tabs, untitled, cross-links everywhere

- No map

- Dozens of graphs

- Hardcoded numbers in each tab

- Assumptions in each tab

- Each tab has a different layout

- Minor details, tiny font size

DO’s in your Financials

- Simple rule of UI: big ultrabold font for messages and titles, 10pt for the rest

- First tab: your summary.

- Tab 2: move ALL assumptions from all tabs into it, group into categories and title each one.

- Tab3: graphs. Remove background and cell grid. Two graphs across max, with a large title in bold font above each one.

- Following tabs: P&L, Cashflow, Balance Sheet, OPEX, HR, KPIs

Again: Simplicity.

Your deck must show the basics – how you make money, fundamental unit economics, when you stop losing cash, when you start making small then big profits. That’s it.

Each slide has a title – use it to your advantage! Explain in the title what makes this company different, better, faster, and quicker to break even. Give out headlines, not technical details. See below for how we do that.

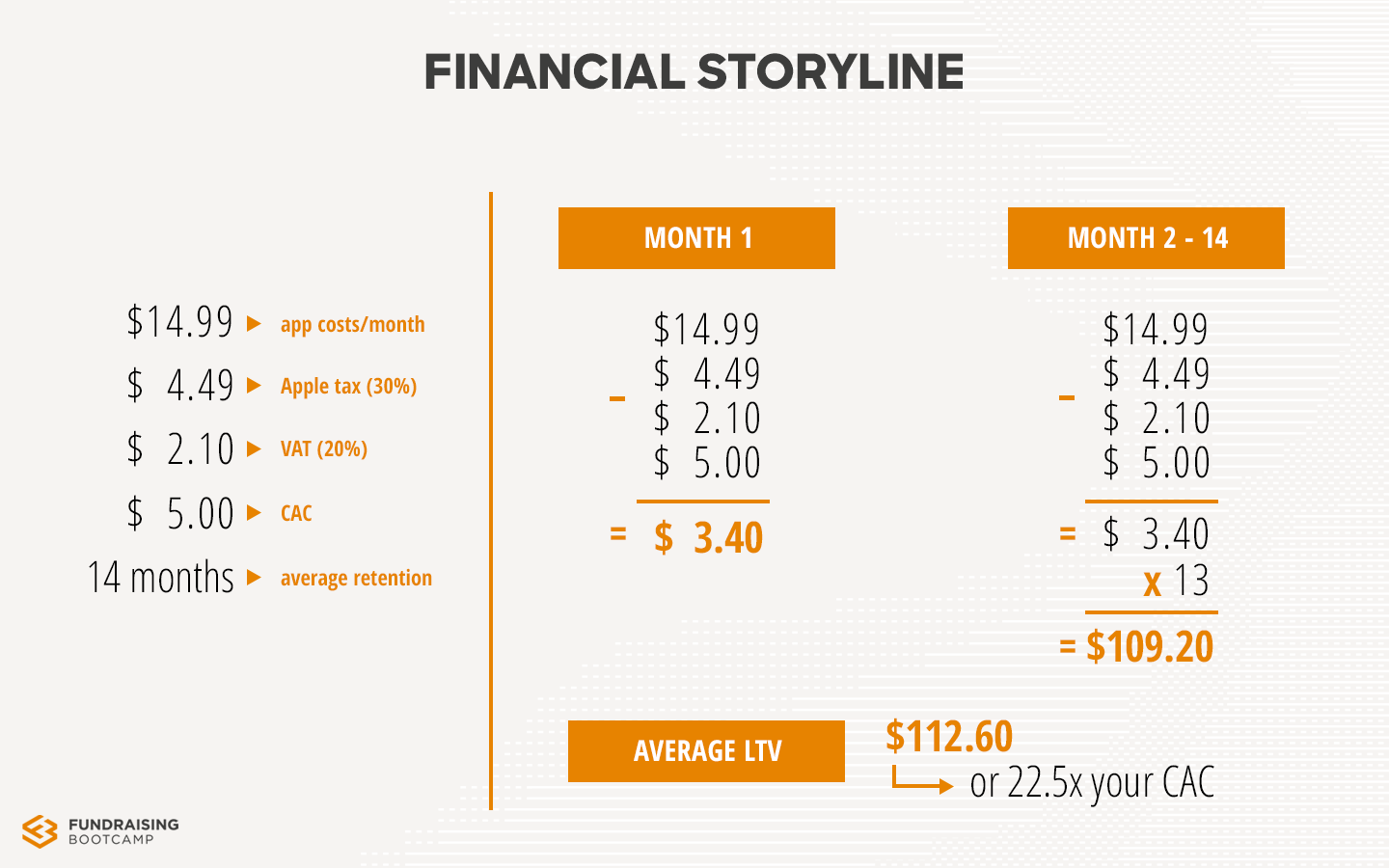

Let’s say you have a fitness app.

- It costs $14.99/month

- Apple tax 30% > $4.49

- VAT at 20% > $2.10

- CAC at $5.00 > $5

- Average retention of 14 months

Simple view:

Month 1

Month 2-14

Average LTV

14.99 -4.49 -2.10 -5

(14.99 -4.49 – 2.10) * 13

> $3.40

> $109.20

> $112.60,

or 22.5x your CAC

Now show simple maths:

X is how much you can scale with the investment you’ll get

Y is how many months it’s going to take your business to reach break-even point

Z is how long it’s gonna take to reach $1 million in profits

That’s literally it. It’s so simple your grandma should be able to understand it (we call it the grandma-test, but a neighbour, non-related, a non-tech person works too);

If they can’t understand and repeat it to you, you haven’t simplified it enough.

Leave space for questions

Just like any good story (and pitch), you must leave details out that could confuse or derail where you’re going with it. Intrigue, not fatigue. Leave some items open (office costs, compensation details, etc).

Questions are good, they create a meaningful conversation (a critical step to building trust) and allow you to see where the investor focuses on, what’s important. It also makes her think she’s adding value (even if untrue and you have the actual answers/numbers).

Leave blanks to open up the conversation.

Now build a story behind the numbers

By now, I guess you get it: VC lingo includes numbers and percentages, so learn what they need to hear, even if they don’t ask you. Can you return their entire fund?

Can you show them, in plain English, how? That’s your financial storyline. A simple story sprinkled with simplified numbers and percentages, that slowly but surely points at an outcome that matches or exceeds their expectations.

And when I say “story”, I mean it. no one thinks of numbers as a tool to tell a convincing story – and very few founders do – that’s how you can stand out, impress and build trust, fast.

Investors are impressed by, and trust founders who know their numbers.

No slide, no pitch, just a simple story with clear, logical components, that lead to a big number, big enough to return their entire fund.

Begin with “we’re building a $xx business” and explain the simple maths (above). Then show some colour, for example how your CAC dropped by accident while searching for a niche in the market for fitness apps, what you discovered; what your top channels were then and now; why and how you discovered them (“total luck” is a valid answer, btw, and builds trust).

Show them you’re comfortable, and familiar, with your numbers (even if just a forecast), focused on optimising them, and learn them by heart. Numbers are dry, but you’re not, and when you put them into some trajectory story, they become exciting. It tells a story, it shows massive growth potential.

And there you have it: the financial storyline. The story behind your numbers.

Not having a solid grasp of your financials is a huge red flag for any investor. If you don’t know how, when, or if you will ever make them a sizeable return of investment, why should they bother investing in you?

Drive the Narrative

The best part of “owning your numbers”? You can drive the narrative to make your company look amazing. Those numbers, often, are often just estimates, but you guide the attention to your salient points. Like a magician you make people focus where you wish them to.

So present:

- An average + trend of your user lifetime value

- An average of the last two years of XX (whatever KPI is relevant)

- An average of last year vs next year

You average it the way you want.

(Side Note: investors love growth, so show growth. Growth of WHAT, it’s your choice.)

Your story in titles

Titles are the backbone, the structure of your story. Like it or not, that’s pretty much the only thing that investors will read when they rush through your deck, flicking through pages. So like an animated flick-book for kids, make your titles add up to a short story.

So drop “Financials”, “Our P&L” and the like, and replace them with a message. state the goal or achievement/s, and drive focus when you need.

“We will hit $10M profit in X years”

“We will break even in one year”

“We will get to 10 million users”

You name it.

“Sounds great, and I have some questions, can we meet so you can tell me more?” is what you want next. Remember how I like to compare a pitch to a bait? Jackpot.

Every investor will have to answer to their board, to their company, and to themselves, the same questions. So help them and make it easy for them to pitch the others: show how big this can become; when it hits financial milestones that matter; when it will make $1 million, $2 million, $10 million and the unit economics to get there.

Focus on what makes you the next $10m/profit company.

The biggest fear of a VC is backing a company that will keep sucking more and more money for years on end, so make sure you show why you won’t be one of them, and how fast you can break even with the money they can give you right now.

There’s a ton more to it, but it’s already way too long a post – and I’m really impressed you stayed on that long. If you need more advice on your financial storyline… ping us.

Good luck!

2nd article I read in a row from you. Love it. Remembering me of the hours spent on our 5y P&L with our lead investor. Days and nights.