Ah, the mystical realm of Venture Capital and Venture Capitalists- the enigmatic beings who hold the keys to startup money. We often talk about VCs as if they’re distant, mythical entities with minds so hard to crack we can’t help but feel intimidated by them.

Reality check: VCs are just like us founders; they want (and need) promising startup founders to succeed and grow big. And to figure this out, they need to understand you deeply. That’s why the pitch matters so much – if you cannot communicate what you do in a simple, comprehensive, yet exciting way, you end up on the ‘meeeeh‘ pile along with the other 2,000+ CEOs they meet that year.

The knowledge to crack the Venture Capital code comes from actual experience

You only get one shot at this; there’s no second chance or iteration. Be knowledgeable and casually demonstrate that magic mix of IQ, team (EQ) and numbers – you’re in. Or end up on the pile. So many have amazing tech but don’t understand Venture Capital, the process, the narrative they need, or how to demonstrate how good they are (hint: not their product).

That’s why we created our programme. To stop great companies and founders from being bypassed for the wrong reasons. The knowledge to crack the Venture Capital code comes from actual experience, not blogs or wishlists. We’ve raised, invested, built, worked in investment banking and sat on all sides of the table. We share it with articles around here and on our LinkedIn, too.

But let’s do something different.

This time, we’ll let VCs do the talking – not because they know something we don’t, but to show you that what we teach is truly industry-insider knowledge of Venture Capital. We’re not teaching theory or anything academic; these recommendations have been part of our curriculum all along, and they match exactly what investors do and say.

Let’s dive into the core of VC-Founder dynamics – where wisdom meets wits.

Make investors feel FOMO

Ego-driven VCs will claim all day that they don’t check out other investors and have no FOMO (Fear of Missing Out). We see, time and time again, that it’s not true, and we built the tools, process and proprietary methodology to unleash it among potential investors – our alumni repeatedly proved that this tactic simply works, especially once they’ve won the first investor/s.

Picture this: a founder methodically (and tirelessly) approaches one VC after another using our Pyramid of Priorities strategy in an enormous uphill battle. Most investors reply by…ghosting them. One day, a relevant VC (industry specialist, reputation, brand) shows interest, and everything changes.

“If fund XYZ is investing, that’s good enough a signal for me”.

The ghosty investors suddenly get very eager to engage, request meetings, and state their undying love of the company. FOMO. As Dan said, “Finding the anchor unlocks the next“. Like magic!

Avoid Industry Jargon

We’ve been saying this all along: you never truly know what kind of experience a VC has in your industry (if any) or what terminology they’re comfortable with. Use jargon at your own peril; usually, all you achieve is to alienate good potential investors who aren’t specialists and make them feel like idiots.

We call it the grandma test (and thank you, Alexis, for confirming!). When pitching to investors, you want to tell the most clear and compelling story you can, leaving them wanting more. Instead, most founders bury their goodness in complexity and complicated lingo or visuals. Alexis said it best: Explain the problem you’re solving so that even a five-year-old could understand.

Set a Fundraising Deadline

Setting a fundraising timeline is a game-changer for founders seeking investment. We wrote an article about our alumni QFlow, their oversubscribed round and how their strict timeline played a massive part in their round. Communicating clear dates creates a sense of urgency among investors, letting them know you will not allow the process to drag on forever.

In today’s market, investors have all the incentives to take their time and explore multiple options before committing, dragging your timeline with them. When you set a deadline, you give investors a reason to act promptly or be out – no more time wasters. It allows those genuinely interested to jump on board, run their process + due diligence, and move forward with conviction. The others are just trying to string you, waiting for you to run out of cash and accept unfavourable terms.

Bootcampers will know we are big on having a strict timeline. And it looks like we’re not the only ones who believe this. The only thing we disagree with is that 10 days is too short, in our opinion. Good investors have other deals in process, so respect their time too.

Read Harry Stebbings’ LinkedIn post.

Venture Capital Strategies in Times of Crisis

Nasty terms have been a part of the VC landscape for a long time and seem to re-emerge in every downturn.

This post from Zoe Peden is a must-read (thank you, Zoe!) as it confirms the sheer bias and dirty tricks hurting founders. We hate it, so we also wrote a whole article on nasty term sheet tricks you can expect in dark times. There’s an entire module on our Fundraising Bootcamp about it because we know how important it is to safeguard your interests early on as founders. It comes from experience, as one of our co-founders fell prey to one of those term sheets and lost everything despite having raised big.

VC funding is the most complex form of capital you can raise. Criticise all you want, search for alternative funding sources (there are plenty, thankfully – we also show you all eight categories, with names and direct links), or cross your fingers and hope for the best.

Or you can learn how the game works, the nasty terms you will likely be offered and how to avoid them. Many CEOs are first-time founders with zero or little fundraising experience, while investors do deals day in and day out. Knowledge is what can keep you safe out there.

Read Zoe Peden’s LinkedIn post.

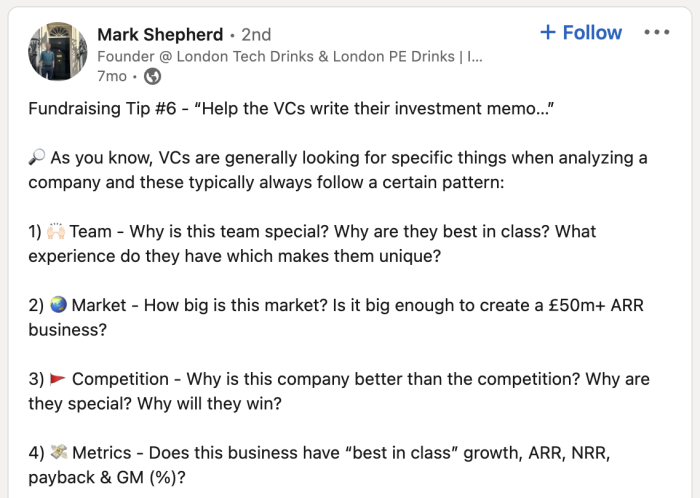

What VCs are Actually After in Your Pitch

Pitch decks are tricky to discuss, but one thing is clear: nobody will spend hours deciphering your deck and looking for what they need.

We have a whole article on what investors actually look at inside your deck, backed by data. Check it out.

At the Fundraising Bootcamp, we don’t believe in decks as the Internet tells you. Your pitch is only bait, and you should consider it as such, nothing more. It is designed to let you express, without referring to any slides, clarity, excitement, numbers/potential and, more than anything else, must make investors keen to know more.

To do that, they ask for a follow-up meeting. Period. Strip the deck out of over-the-top explanations about your vision, mission, product, tech maps, founder’s love story, etc. The deck answers some basic questions: Investors seek concrete data and numbers. They’re looking for your team. They need to know if your market is big enough, and if you have enough traction, and they usually spend most of their time on your financials. There are other items you must display, even if they don’t ask you for them.

Read Mark Shepherd’s LinkedIn post.

And there you go! Five times, investors validated what we teach thoroughly at Bootcamp. If you’re unsure how to act on this advice, you should join one of our cohorts. We have the playbook and can help you nail your next round.

Click here for more info, see where our next programme runs, and don’t take our word for it. Check out our wall of CEO reviews instead.